Road Report: ADP's 2022 Analyst Day

Posted on Wednesday, September 14th, 2022 at 12:35 PM

Late last week, I had the opportunity to spend a day with the senior leaders at ADP in their Innovation Lab in NYC. It was a flawlessly run event and I appreciated the opportunity to both listen to execs and actively participate in conversations on how to improve their products. This blog is a quick round-up of my takeaways from the event. You can also check out the Twitter thread at #adpaday.

At a high level, here are my key takeaways from the day:

- Consistent revenue growth: ADP grew 10% in revenue in FY2022 to $16.5 billion and experienced a 15% increase in new business bookings, growing $1.7 billion last year. The company is just short of 1 million clients, reporting 990,000 clients as of the end of FY22.

- Continued focus on comprehensive and unique HCM data set: A highlight of the session was ADP’s announcement of its new National Employment Report, which seeks not to be a forecast of the Bureau of Labor Statistics (BLS) report, but instead an independent estimate of employment. This report is being augmented by a 2,500 US adult worker survey of sentiment on things like engagement, connection, resilience, etc.

- Growth – though not as much as expected – in HCM platforms: ADP’s Workforce Now HCM platform for mid-market customers continues to perform well whereas its Next Gen HCM, targeted at larger, global customers, got off to a slower start than ADP hoped for, but is fully underway now.

- Increased focus on EX: Like many others in the space, ADP is focusing heavily on employee experience and engagement. They are making additional investments into their employee experience offering and launched an employee voice survey offering in July 2022.

Note: This blog was publicly available for 48 hours, after which point it became available only to RedThread members. Sign up to become a member at https://members.redthreadresearch.com.

Update: Visier Gets in the Collaboration Analytics Market with Yva.ai Purchase

Posted on Tuesday, May 31st, 2022 at 1:21 PM

Update: We published this blog in early May when news of Visier’s acquisition of the assets of Yva.ai was announced. We were recently briefed by Visier leaders on the acquisition, and we had the chance to ask the questions we had originally laid out in the blog. We have republished this blog along with the responses. If you have already read this blog and would like to skip to the updates, please scroll down to the last section.

Last week, Visier announced its acquisition of the assets of Yva.ai (pronounced ee-vah, like the alien robot in Wall-E), an AI-driven collaboration analytics vendor. This is interesting news in our space because of what it says about:

- The shifting use cases in the PAT market

- The rising importance of continuous, passive data analytics

- The continued consolidation of people analytics tech

This blog took a little while longer to write than usual because there’s a lot to say about these two different technologies and the shifts within the market. In the below, we cover the following:

- Overview of Visier and Yva.ai

- Background on Multi-source Analysis Platforms (MSAPs) and shifting people analytics tech use cases

- What is a collaboration analytics tool?

- What is Yva.ai?

- Why did Visier acquire the assets of Yva.ai?

If you aren’t looking for any background on the space, feel free to skip bullets 2 and 3.

Overview of Visier and Yva.ai

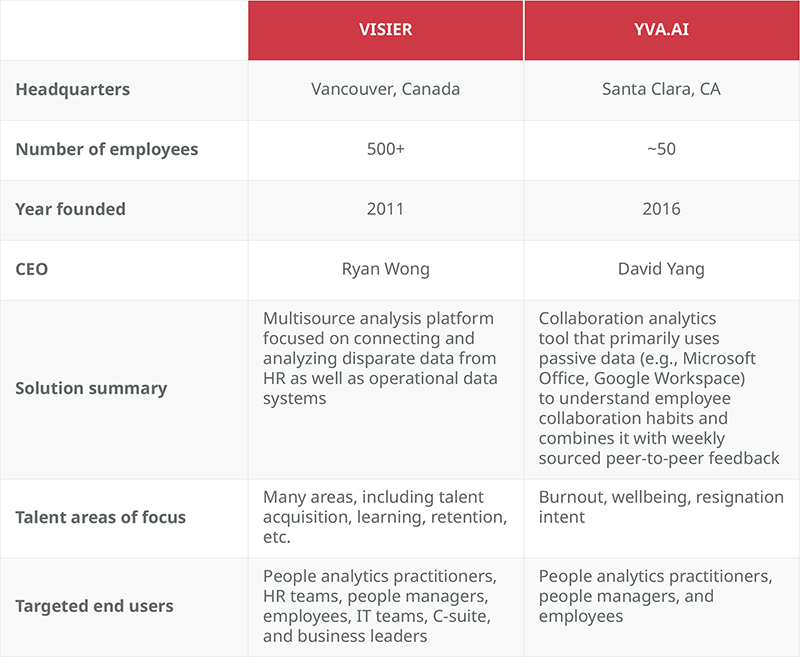

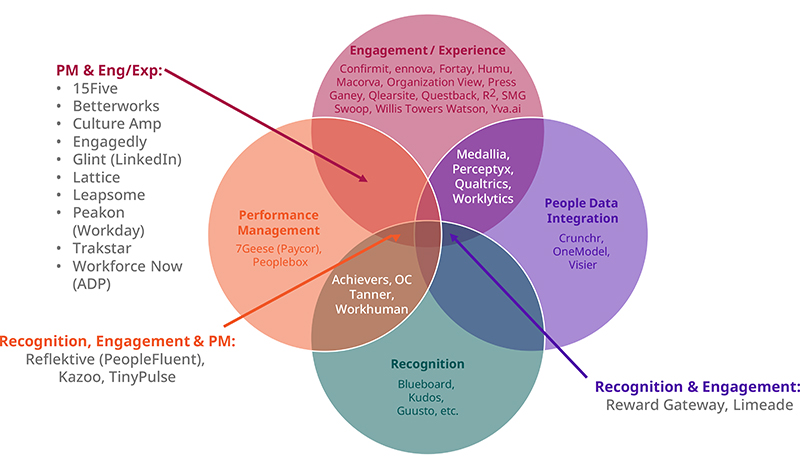

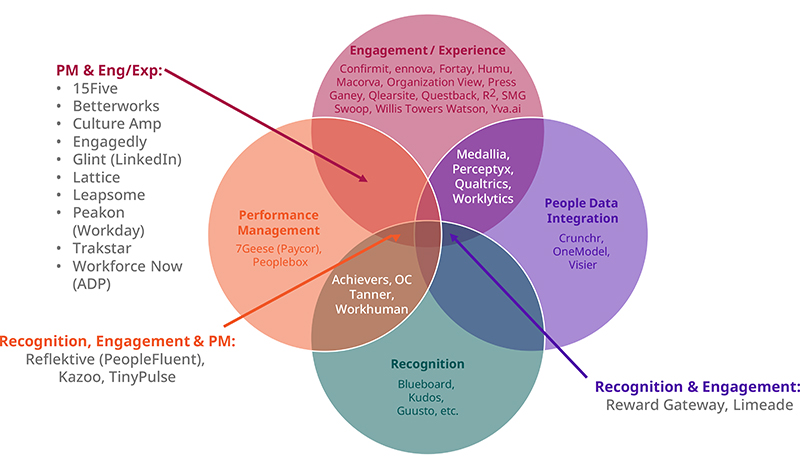

Let’s begin with a quick review of who is who (see Figure 1). Visier is what we call a “multi-source analysis platform” (MSAP), meaning it connects data from existing HR systems (e.g., HRIS, LMS / LXP, TM) and other operational systems (e.g., sales or customer data) and enables robust analysis and distribution. Yva.ai is a collaboration analytics tool that combines data from corporate tools, such as Microsoft Office 365 and Microsoft Teams, Zoom, Slack, and other collaboration tools, and enhances it with weekly sourced peer-to-peer feedback.

Background on Multi-source Analysis Platforms (MSAPs)

Before we get to more specifics on Visier and Yva.ai, let’s first talk about what MSAPs are and their current opportunities and limitations. As mentioned above, MSAPs allow companies to integrate data from existing HR and other operational systems, analyze that data, and distribute insights about it at appropriate levels of security throughout the organization. These insights are used by people analytics and HR leaders, and, increasingly by business leaders, managers, and individual employees.

There is an incredible amount of power in this type of system. By bringing together disparate data, these systems can create a single, integrated source of data truth, which can then be used to answer critical questions about what is happening with the workforce. Our research shows that effectively using integrated people analytics data can help impact businesses in terms of millions and sometimes billions of dollars, as we wrote about in our report, Unlocking the Hidden C-suite Superpower: People Analytics. These types of significant business outcomes are typically the result of people analytics teams working to help answer strategic business questions, with the support of the CHRO and senior business leaders, who make the final decision.

Yet, the people analytics team is only so big in any organization and can only answer so many questions themselves. By putting data into the hands of more business leaders, managers, and employees, organizations could enable more people to make better, data-backed decisions about people, and thus better enable those organizations (and people!) to thrive. This is the dream that many of us in people analytics have for the future.

Shifting PAT Use Cases

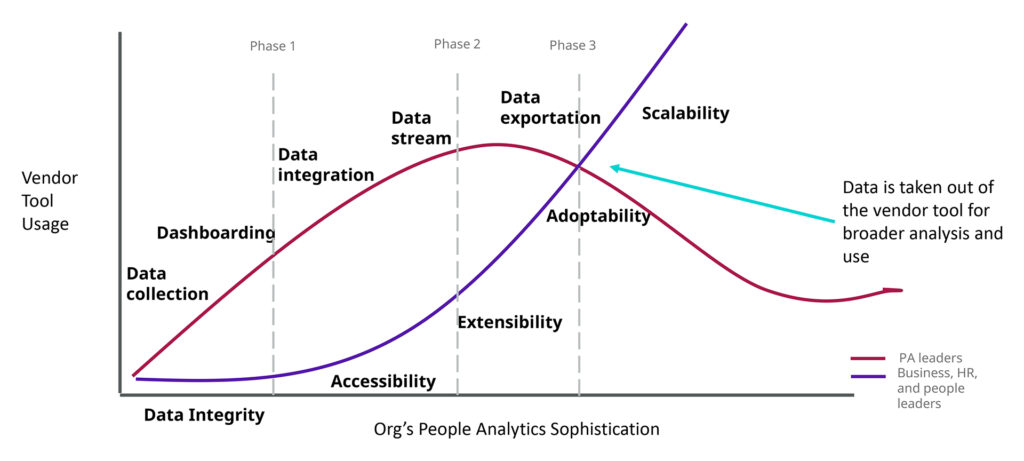

Putting data in the hands of the masses is not just a dream for vendors – in fact, it is a necessity for their future. As shown in Figure 2 (a sneak peek into next week’s release of the People Analytics Tech study), we’ve found that the use cases for people analytics tech are changing. Specifically, as people analytics teams increase in sophistication, they use vendors – especially MSAPs – to integrate increasingly complex data. At some point, though, some of the people analytics teams will take this holistic, integrated data set out of the multi-source analysis platform and put it into a centralized data lake, doing less of their work in the platform. This allows those PA teams to do more sophisticated research and analysis.

Yet, that doesn’t mean MSAPs are no longer important – in fact, it is just the opposite. This is when these systems can become the most valuable. As the data become richer and more continuous (meaning they change and update on a continuous basis), they have increased value in terms of helping business leaders, managers, and employees make better decisions. MSAPs are superb at scaling and sharing data and insights across complex enterprises. Further, given the time that it takes organizations to adopt new technologies, it is just at this point (between Phase 2 and Phase 3 in Figure 2) that these technologies start to be adopted at the scale necessary to drive meaningful insights across the business.

However, for MSAPs, there is a stumbling block in achieving this dream of ubiquitous use: The data these systems integrate often doesn’t change frequently enough to entice senior business leaders, managers, or individual employees to want to look at it continuously (e.g., daily). (Sorry friends, I know some of you will disagree. However, our research shows that 17% and 8% of MSAPs are accessed daily by people managers and employees, respectively. And, to be honest, I think there might be some inflation in those numbers.)

This is not the fault of these solutions. It is, instead, due to the nature of the data they pull in; for example, promotions only happen a few times per year, engagement data are still only collected annually or semi-annually in many organizations, and learning data may not be as robust or relevant as everyone hopes. This is a problem that MSAPs must solve if they are going to get to the next level of adoption across their non-HR / people analytics end users.

And so, with that understanding of what is happening for MSAPs, let’s turn to the other partner in this acquisition: Yva.ai, a collaboration analytics tool.

What is a collaboration analytics tool?

A collaboration analytics tool allows leaders to bring together passive data that are generated through employees’ daily interactions with each other – think Microsoft Office 365 and Microsoft Teams, Zoom, Slack, and other collaboration tools – and generate insights from those data.

There are some real benefits to these types of tools. For example,

- Analysis of these data can be highly predictive of burnout, turnover, etc., so this can help leaders identify and address challenges earlier

- These data do not have to be collected actively (e.g., via a survey), so employees don’t have to be disturbed / leaders don’t have to wait to ask employees how they are doing

- These data can be delivered back to employees to give them heightened self-awareness

Yet, as you can imagine, there are also some concerns with these types of tools:

- There may be concerns of “Big Brother” monitoring, which can erode trust, if it is not made clear what data are being collected and analyzed. Many tools require employees to opt in – not opt out – which can help address this concern. Also, companies can control the level at which data are reported, so information isn’t necessarily tied to individual employees.(Note: We wrote separately about some of these issues in this blog about Cultivate when it was acquired by Perceptyx.)

- Managers may not use these insights appropriately if they don’t understand that they are predictions, not certainties. Further, some managers may use this information to target specific individuals if they already suspect that they are planning to leave. This can be addressed by controlling the level at which managers can receive these data / insights (e.g., not reporting on fewer than 5 employees) or rolling these capabilities out slowly so as to train / enable managers appropriately.

Despite these concerns, it is important to recognize that using collaboration analytics will increasingly become the norm, especially in locales not restricted by GDPR. There is simply so much power in these data that it is unlikely they will remain ignored for much longer.

What is Yva.ai?

Yva.ai is a collaboration analytics tool and was a spinoff from ABBYY, an AI company that helps customers with their digital transformations. Until last week, Yva.ai focused on helping customers understand employee dissatisfaction by combining active and passive employee data and using it to understand employee well-being. It also uses AI models to help companies predict resignations and address the issues that might be driving them.

Some of the differentiators for Yva.ai include:

- Helps companies avoid employee resignation by detecting and addressing burnout early

- Predicts employee resignations within a week with 94.5% accuracy, within 5 weeks with 88% accuracy, and within 3-6 months with 70% accuracy

- Combines active data collected from weekly micro surveys with passive collaboration data

- Enhanced data security for passive data analysis that only looks for semantic signals and destroys the contents after analyses

- Offers smart feedback capabilities: The system can identify employees who should be asked about whom and when, based on passive data collection

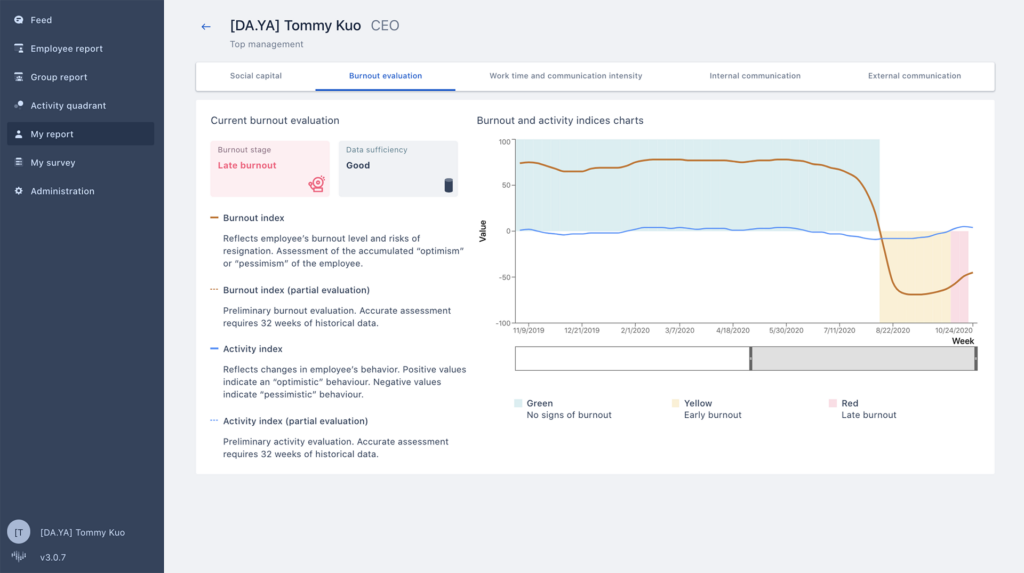

When we conducted our review of Yva.ai a few months ago, some of the things that most excited us about the tool included:

- Personal dashboards for employees based on data collected on and from them that allows them to compare their data against organizational level data and share insights with others

- The increased focus on data anonymization, employee privacy, and security by aggregating data, allowing employees to opt-in and opt-out of data collection when they want, and ensuring customers either self-host their data on the cloud or on-premise

- Additional frequent listening capabilities through pulses and micro surveys for companies that only have annual or quarterly engagement surveys

Finally, a few other things of note about the company:

- Organizational network analysis capabilities allow understanding of who works with whom across office collaboration tools such as Slack, Teams, Jira, etc.

- Natural Language Processing (NLP) capabilities to analyze anonymized text data collected from office collaboration tools such as Slack, Teams, Jira, etc.

- Diversity metrics are built-in as a core module, available throughout the entire platform

- Smallest unit at which it reports data is a group of 5 individuals

Why did Visier acquire the assets of Yva.ai?

The primary reasons Visier bought the assets of Yva.ai include:

- The ability to connect what people are doing to outcomes

- The creation of sticky, continuous insights for non-HR / people analytics users

- The underlying AI and NLP technology

Connecting how work is done to outcomes

The headline reason for this acquisition is that it will allow Visier to connect insights on how people are working to the outcomes they produce. This should allow companies to better understand their employees and make better decisions. As Visier CEO Ryan Wong stated:

“Collaboration analytics reveals new insights into how people and teams work together. It enables us to go from understanding “who” and “what” to answering questions about “how” people work best… Now, our customers will have a 360-degree view of what their employees do, how they feel and how they work together. The Visier People Cloud’s outcome-focused insights give leaders the guidance they need to make better decisions. Ultimately, it’s our belief that the companies that best understand their employees will be the ones that thrive in the future of work.”

Creation of sticky, continuous insights for non-HR / people analytics users

As mentioned above, many MSAPs are looking to engage non-HR / people analytics leaders more. The acquisition of a tool like Yva.ai helps Visier address this challenge. Collaboration data can tell users something meaningful about their workforce (or themselves) on a daily (or weekly basis). Again, CEO Ryan Wong identified this as a primary objective for the acquisition

“Leaders can use this combination of active and passive listening capabilities to gain deeper insight beyond individual workers and focus on relationships within networks of people, and the overall wellness of their teams. With this knowledge, managers gain a better understanding of team dynamics and employee well-being. But beyond the leadership benefits, these insights also empower every worker. Employees can gain a deeper understanding of where they are spending their time and who they are working with, and uncover pathways to improving their interactions, collaboration and performance.”

The underlying AI and NLP technology

Yva.ai has some of the most sophisticated AI and NLP technology available on the market right now. With the vast amounts of data available at its disposal, Visier will certainly find interesting ways to deploy that technology. Our hope is that they will use it to simplify the process of finding insights for business leaders, people managers, and employees.

Additional thoughts

One of the interesting things about this deal is that it is an acquisition of the assets of Yva.ai, not of the company as an entire entity. This is typically a strategy acquiring companies use to reduce risk and potential losses, as it enables them to cherry-pick which parts of the company they want, often leaving undesirable portions (like liabilities). We don’t know why Visier chose this approach as opposed to a traditional acquisition strategy.

One of the implications of an asset acquisition, though, is that Visier did not automatically bring over all the employees from Yva.ai. They did, however, hire more than 30 Yva.ai engineers and data scientists, the majority of its global workforce. This additional headcount should strengthen Visier’s tech capabilities, in a time when it is really hard to hire engineers.

Some of the questions we have about this acquisition are:

- Cultures: This is Visier’s first acquisition, so it is just building its muscle at integrating outside technology and teams into its organization. This deal will bring in a portion of the Yva.ai team, many of whom have been working at the cutting edge of AI and machine learning technology, and in different locales than Vancouver-based Visier. There may be a very different set of cultural expectations between these teams. Update, based on 5/26 briefing: Given the fact that a large portion of the Yva.ai team will now be part of Visier, we were curious to understand how the cross-fertilization of backgrounds, expertise, and cultures would work. The short answer is that it will be done gradually and in a natural and organic way. Visier will be relocating more than 30 Yva.ai engineers and scientists to Vancouver and expects the alignment to happen easily because of the similar cultural mindset of the companies and common background of focusing on product innovation. Another reason they expect this cultural integration to happen easily is because of the alignment between the companies on the vision. As a people analytics solution, Yva.ai had helped companies identify and address burnout and improve employee well-being through collaboration analytics. Visier also believes that these issues are topical and highly relevant to getting work done. As a company focused on helping customers solve challenges around hiring, retention, and DEIB, among others, topics of burnout and well-being fit nicely into the fold and will provide additional value to their customers. We look forward to seeing new use cases and the new capabilities in action.

- Leadership: It’s not clear what role Yva.ai’s CEO, David Yang, will have within Visier. However, he has clearly been the visionary behind Yva.ai’s tech, and we wonder what will happen to that vision and Yva’s execution capabilities if he leaves or does not remain in a position of product leadership. Update, based on 5/26 briefing: For now, we were told, David will assume the role of a principal, reporting up to Visier’s CEO, Ryan Wong, and will continue working on the innovation side of things. As we mentioned above there is a lot of alignment between David’s vision and what Visier wants to enable its customers to do. Like Yva.ai, Visier believes in the power of using active and passive data to identify and solve problems quickly. Through Visier, Yva.ai’s technology will be easily available to a wider set of bigger-sized customers who are already familiar with the benefits of people analytics and might be more readily open to passive data collection. As Visier works to integrate the new technology into its own products and offerings, we foresee David to continue playing an important role in the product development for now.

- Data privacy and ethics: Traditionally, Yva.ai has used an opt-in model for its data. We wonder how that will work as Visier tries to tie those data to the rest of its data – and what happens to them if / when employees opt out. And how that then impacts the value proposition for business leaders and people managers? Update, based on 5/26 briefing: Visier acknowledged that this is a complex issue, especially because Visier, being a champion of democratizing insights, has plans to share insights on data collected from employees back with them. The company will work to figure out issues of consent around data collection and the different legal requirement in different regions. Ultimately, we were told, customers will have to make the decision around privacy themselves, but Visier will provide guidance on best practices.

Moving forward

The collaboration analysis tool market will continue to grow as more companies realize the power of data they are already sitting on and become more accustomed to using it. That said, we expect to see many of the vendors in this space entering into partnership agreements or getting purchased, as these data and the associated analysis are fundamentally more powerful if they are connected to other types of data. Therefore, expect to see some action with some of the other vendors in this space such as Glickon, Network Perspective, RSquared, Swoop Analytics, and Worklytics.

Update from the road: Bringing humanity back at Workhuman Live

Posted on Friday, May 20th, 2022 at 1:34 PM

We attended the Workhuman Live conference from May 16-19 which took place in Atlanta, Georgia. With about 1,800 people in attendance, it was the biggest in-person event we have attended so far this year. Besides the joy of meeting old friends and making new ones, the conference filled us with a sense of optimism and positivity around the future of work. Overall, the event was all about bringing “humanity” back into work.

Key takeaways

Connections are more important than ever

In keeping with its tradition of making the conference relevant and real, Workhuman made sure that this year one of the key messages was around something we all missed during the pandemic¾deep human connections. We heard a lot about the importance of building and managing connections. For example, Dan Heath spoke about the importance of connections during his keynote as he emphasized the role they play in creating moments that matter and in elevating experience. The conference itself was designed to facilitate conversations among attendees by helping them connect, share ideas, and spark conversations through “braindates” that could be set up via the app.

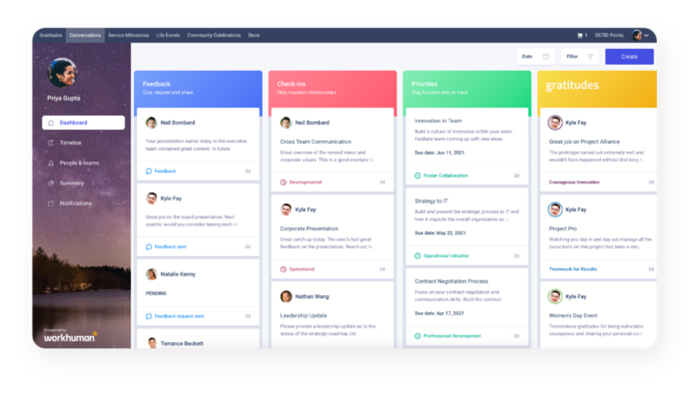

This was also emphasized by Workhuman through their own existing product, the Conversations tool, which is part of their Workhuman Cloud suite (Figure 1). The tool is designed to encourage conversations and check-ins between employees, managers, peers, and coaches to facilitate performance development. The check-ins can be prompted by anyone and are supported by feedback that can be requested by employees anytime. With the company increasingly leaning into the performance management space, it was great to see it emphasize the positive impact such tools can have as shared by one of their customers ¾IBM. Since launching Workhuman, leaders at IBM have watched feedback requests and responses increase 5x what they were before. We expect to see Workhuman do more work on this front in the future.

Care is integral to performance

Keeping in line with the overall theme of humanity, self-care, and being considerate of others’ needs was a topic that came up often during the different sessions. Whether it was the honest conversation and stories shared by Simone Biles or Malcolm Gladwell’s keynote, we were pleased to see emphasis laid on breaking down old practices and behaviors if they no longer served the purpose for which they were designed.

Talking about her journey and her appearance at the 2021 Olympics Simone Biles, in conversation with Workhuman CHRO, Steve Pemberton, emphasized the importance of well-being, mental health, and performing for yourself. The message was extremely relevant at a time when a large portion of the workforce has found themselves struggling with mental health related challenges in the workplace.

Care is also about being considerate of other peoples’ differences and putting in place systems that account for those differences rather than discriminate based on them. Malcolm Gladwell spoke about the need to do away with systems and policies that are there just because “this is how we have always done them.” Instead, he emphasized the need to consider the different abilities and skills that people can bring to the table and harnessing them in ways that benefit everyone.

DEIB is essential for hybrid work

With a lot of talk about hybrid work came a lot of discussion about the need for organizations to be inclusive and fair. One of the sessions was led by McKinsey and discussed the dangers of forcing employees to return to offices as the majority of employees prefer some form of hybrid work according to their latest research. The speakers talked about the need to be inclusive when it comes to designing return to office policies by providing work-life support, showing respect and concern for well-being, and fostering collaboration among team members.

Particularly interesting was the session by Josh Levs, where he spoke about how the workplace and society fail men when it comes to practices around paternal leave and caregiving. In an extremely moving talk, Levs spoke about his own personal struggle of becoming a new father and working in a place that did not afford him, as a man, any time off to care for his newborn. The session highlighted the need for a shift in thinking around the notion of society expecting women to be the primary caregiver because of the adverse impact it has on their role in the workplace and ultimately slows business growth. This was especially relevant for a few reasons. Many working mothers found their caregiving responsibilities increase severalfold during the pandemic, leading them to quit the workforce. Additionally, the current national baby formula crisis is putting extra strain on the physical and mental health of already overburdened working mothers who are often expected to be the primary and (in many cases) sole provider of childcare.

What we liked most

The educational nature of the content. There was a very good mix of analysts, customers, non-customers, and vendor partners in attendance, and there was something for everyone. Workhuman Live has a history of bringing together thoughtful leaders and this year was no exception. There was a lot to learn about not just creating better workplaces but also about how to be better towards each other as humans and most importantly, towards ourselves.

The vibe. As we said earlier this was a conference that celebrated humanity. While Workhuman demos and solution briefings were provided along with some customer success stories, the conference was less about selling and talking about the success of the solution and more about creating better experiences for everyone. Each day began with a mindfulness and meditation session to improve awareness and connection. The conference area was peppered with stations such as Gratitude bar, Book café, photo stations and much more.

Seeing old friends. This one is a bit personal, but wow, was it great to see a lot of folks we’ve missed for the last 2+ years. Getting to connect like this really reminded us how wonderful our HR community is and how lucky we are to do the work we do.

Overall, this was a fantastic event. We look forward to the next Workhuman Live.

Update from the Road: Perceptyx Reports Strong Growth at its Insights Conference

Posted on Wednesday, May 18th, 2022 at 6:25 PM

I spent the last two days in Texas with the Perceptyx team and approximately 200 of their customers. Held at the Hyatt Lost Pines resort, about 30 minutes outside of Austin, the event was an enthusiastic celebration of being together again and of Perceptyx’s successes over the last few years. The team also made sure event attendees got a good dose of Texan culture, bringing in longhorn steers, a top-notch country western band (complete with line dancing lessons), and wonderful Tex-Mex food.

While I live-Tweeted the opening keynotes from CEO John Borland, CTO Sham Telang, and their external keynote presenter Seth Mattison, I thought it could be useful for you all if I do a quick round-up of key takeaways from the event. Here are the top highlights:

- Significant growth since pre-pandemic

- Excellent customer stories

- Compelling vision around the product roadmap

Significant growth since pre-pandemic

In the opening session, Borland expressed his thanks to customers both for attending the event (approximately 80-90% indicated via a show of hands that this was their first post-pandemic event) and for their support during the pandemic. He has good reason to be thankful: Since before the pandemic, Perceptyx experienced a 260% growth in revenue and a 150% growth in the number of customers. Further, many of those customers are blue-chip companies, as was shown in their slide of customers in attendance at the event.

It appears that Perceptyx has been able to manage that growth effectively, given that they reported a Net Promoter Score© (NPS) of 74, which is higher than the people analytics tech industry average of 59.

Excellent customer stories

Given that NPS, it is not surprising there were a plethora of strong customer stories on display at the event. Some of the most notable came from the main stage, where the following organizations presented:

- Abbvie, S&P Global, and Advocate Aurora Health had Dr. Bethany Dohleman (Director, Human Capital Research), Kate Brown (VP, Culture and Engagement), Meghan O’Brien (People Project Lead), and Rebecca Daisley, PhD (Director of Talent Management) present on “How to Future-Proof Your Organization.”

Key Insight: Flexibility and agility are key to transformation.

- AB InBev had Valerie DuBois (Global Director, Employee Experience) present on “The Secret to Empowering and Influencing Your Leaders.”

Key insight: By putting data in the hands of managers, you can create ownership of understanding and solving the people problems orgs face.

- UC Health, where Matthew Gosney (VP of Organizational Development) and Ashley Bruning (Chief Nursing Officer) presented “Create an Employee Voice Strategy Built for Impact.”

Key insight: The conversation is the relationship. (Oh, and Colorado is drop-dead beautiful.)

- WPP (the largest advertising agency holding company) had Judy Jackson (Global Head of Culture) talk about “Getting Comfortable (and Brave) with the Uncomfortable.”

Key insight: Meetings are like plays – you need to know your audience and which actor will best deliver which line. Sometimes, if you are part of an under-represented population, the right “actor” to present sensitive race / ethnicity data is someone from the majority population.

All of those sessions will be available on replay later, and I suggest you have a listen to them, if you have the chance.

I also had a chance to attend a few breakout sessions, and especially enjoyed the following ones:

- Ahold Delhaize had Shanna Daugherty (Global Manager Associate Development) present “An ‘Ecosystem’ Listening Model for A Disparate Workforce.”

Key insight: A comprehensive listening strategy will allow you to create meaningful insights, such as measuring the link between employee experience and store performance and the impact of leadership development programs.

- Boeing had Kristin Saboe, PhD (Senior Manager, Employee Listening, Research, and Talent Strategy) and Frank Zemek (Employee Relations Specialist, Employee Engagement Survey) present “Innovative Approaches to Continuous Listening & Acting at Scale.”

Key insight: Enabling employees to launch their own surveys can unleash incredible power in orgs, but needs to still have some centralized management so as to stay legally compliant, make sure audiences aren’t over-surveyed, and stakeholders are appropriately engaged. It also scares the heck out of a lot of practitioners (judging from the questions in the room).

Compelling vision around the product roadmap

In the morning, Sham Telang, CTO, shared the product roadmap. He indicated that Perceptyx is trying to solve the problems of:

- Fragmented data

- Disjointed user experience

- Missing linkage between employee experience, behaviors, and actions

- Manual reporting and analytics

The way Perceptyx is trying to address this is by offering four distinct product and platform capabilities – Monitor, Listen, Enable, and Activate (see Figure 2) – under one umbrella (see Figure 3). The idea is that the four products, Ask, Sense, Dialogue, and Develop, will enable a holistic listening strategy for organizations.

As many of you know, Perceptyx recently acquired three companies, CultureIQ, Waggl, and Cultivate. This new 4-product strategy heavily incorporates those latter two acquisitions, specifically:

- Ask – This is the traditional Perceptyx employee experience and engagement product, which can include big annual census surveys or other special-focus surveys (e.g., DEIB, Covid-19).

- Sense – This is the traditional Perceptyx lifecycle and pulse survey product, but it will have some of Cultivate’s passive listening capabilities integrated into it moving forward.

- Dialogue – This is the Waggl acquisition, which can enable crowdsourcing, conversations, pairing and voting (using conjoint analysis techniques). Perceptyx is positioning this as a way to accelerate action planning after using the Ask or Sense products by immediately engaging the organization in crowd-sourced ideation and discussions about how to move forward (see Figure 4).

- Develop – This is the Cultivate acquisition paired with the traditional Perceptyx 360 offering (see Figure 5). The initial offering will be combining that 360 information with feedback on employees’ behaviors, derived from their digital exhaust, to provide insight into their “blind spots.” For example, if someone indicated in a 360 that their manager doesn’t recognize them enough, but the manager thinks they do recognize enough, then Cultivate can then flag for that manager when they are recognizing their employee less often than usual or less than their colleagues.

I’m not sure where or in what ways CultureIQ is incorporated into this product strategy.

A number of other updates were also mentioned:

- Listening Home – This is designed to be a one-stop-shop for finding all of this listening data and for developing action plans on it (see Figure 6). It will include an “In the flow of work” bot (presumably based on Cultivate) to provide nudges, coaching with recommendations, etc.

- Seamless HCM integration – Today, Perceptyx integrates HCM data via flat files. Beginning in Q3, they will have integrations with all the major players (Workday, SuccessFactors, and Oracle).

- Upgraded UX for Analyze dashboards – This was just released prior to the conference, and actually generated a spontaneous cheer in the room, indicating folks’ enthusiasm. The new UX has a better look and feel, improved underlying infrastructure, and faster performance.

- ML/NLP-powered dashboards – Coming in Q4, Perceptyx plans to improve its ability to use machine learning (ML) and Natural Language Processing (NLP) to highlight sentiment and insights from the data. These will first roll out to their Engagement, D&I, Attrition, and Benchmark surveys.

- Standardized widgets for dashboard creation / configurable dashboards – Billed as “coming soon,” Perceptyx is enabling customers to use standardized widgets to create custom dashboards. They are also offering more out-of-the-box dashboards, which customers can configure. In conversations with customers, this enhancement was one of the ones that excited them most.

Final thoughts

Perceptyx has significant momentum and a clear vision for being a one-stop-shop for employee listening. As one of the (dwindling number of) independent vendors left in the space, they are able to focus on customers’ needs exclusively, without being distracted by the demands of a larger organization that may have other primary objectives. Perceptyx is driven by its vision, mission, and values (see Figure 7), which have a strong emphasis on succeeding “together” with customers. That customer-centricity came through strongly in many of the conversations I had with customers at the event.

The next thing will be for Perceptyx to deliver on their product vision by effectively integrating its acquisitions. While Waggl was the acquisition customers seemed to most intuitively understand – this may be because it’s an older acquisition so Perceptyx could more effectively message how it fits in – I am most excited by the opportunity for Cultivate to help Perceptyx differentiate itself more from its competitors. The underlying AI, which will power sentiment analysis, collaboration analysis, and targeted nudges, has the potential to truly change how employees and leaders understand themselves and their teams. I’m looking forward to seeing what the next year has in store for Perceptyx.

Learning Technologies Conference 2022 – Key Takeaways

Posted on Tuesday, May 17th, 2022 at 1:17 PM

Early May saw the Learning Technologies conference take place (in person!) in London. Typically held in February / March, it was postponed this year to May due to COVID. The event drew a crowd of learning leaders–mostly from North America and Europe—to discuss all things learning tech.

It was my first in-person conference since the pandemic started, and man was it fantastic. There really is something about connecting face-to-face (not through screens) that makes me, at least, feel more alive and connected.

Key Takeaways

Here are my 5 biggest takeaways from the experience.

DEIB & Learning was a running theme

It was clear that Donald Taylor and the event team intentionally wove diversity, equity, inclusion, and belonging (DEIB) into the conference program. The speaker lineup, for example, was clearly crafted to include people with a range of different backgrounds and perspectives.

And in the opening keynote, author and speaker Matthew Syed talked extensively about the value of cognitive diversity. I appreciated his emphasis that the more complex the problem or situation, the more diverse perspectives might help reveal innovative solutions. He also illustrated how cognitive diversity and demographic diversity are not the same, but are often correlated.

That said, the panel on diversity, inclusion, and learning wasn't particularly well-attended. Perhaps 30 or 40 people showed up, whereas other sessions drew well over 200 attendees. To be fair, the panel was scheduled at the end of Day 2, when many people were already leaving to catch planes and trains. Perhaps some people wanted to attend but couldn't.

Speakers emphasized growth mindset and partnering outside the L&D function

In addition to DEIB, during the 2 days of the conference we heard a lot about growth mindset and the importance of partnering outside the L&D function.

Growth mindset, a term coined by child psychologist and Stanford professor Carol Dweck, has made its way into the L&D ethos in recent years. Fundamentally, it's the belief (mindset) that talents can be developed, rather than being innate gifts we're either born with or not. This year's Learning Technologies conference featured lots of talk about the importance of fostering a growth mindset in organizations. There's a growing understanding that growth mindset can help build learning cultures and foster things like collaboration and innovation.

Another theme that wove its way into many other presentations was partnering with teams outside the L&D function. Speakers talked mostly about working with other talent / HR teams, but some mentioned legal, IT, procurement, and other functions. Overall, I was thrilled to see an emphasis on reaching out and partnering. L&D functions are finally looking up and around, thinking about how to break down the silos that have existed for so long in so many organizations.

Participants were most interested in skills and learning analytics

The sessions that were most heavily attended had to do with 2 things:

- Learning analytics and learning impact. There were 2 sessions in particular that focused on learning analytics and measuring impact. Learning leaders seem to be moving away from the long-held conviction that, to be of any value, learning analytics must prove a direct, causal link between learning activities and business outcomes. That conviction has, I believe, held L&D functions back from trying to measure anything other than "bums in seats" and "smile sheets." So I was thrilled that the presenters at Learning Technologies focused on how to identify correlations (not causation) between learning activities and outcomes the organization as a whole cares about. They talked about relating learning activities to outcomes like employee engagement, diversity and inclusion, production efficiency, strategic priorities, or even sales. One of the speakers, Peter Manniche Riber, showed a slide titled, "Alternatives to the Happy Sheet" that might have been the most-photographed slide of the conference.

- Skills. Based on session content and the questions asked during Q&As, most organizations are still at the very beginning of their skills journeys; nobody has it figured out. L&D functions are grappling with the question: What skills do we have in our workforce, and what skills will we need in the future? They're interested in systems, processes, and tech that can help them map the current and needed skills in their organizations. One of the most interesting tidbits about skills came up during Day 2's opening keynote, when Marco Dondi of McKinsey & Company shared research that identified 56 distinct elements of talent (DELTAs): skills and abilities that will be key to work in the future.

People were happy to connect in person

I wasn't the only one thrilled to be in person with people again. Learning Technologies draws many loyal attendees—I talked to at least 10 people who've come every year for a decade—and participants were incredibly excited to see old friends and colleagues after a 2-year hiatus.

Talking to the conference organizers, I was struck at the thought that was put into enabling people to connect in meaningful ways. Breaks were 45 minutes long—longer than many other conferences I've attended—to allow people to have good conversations. There were lots and lots and lots of evening networking events and parties. And in true European fashion, wine was served at lunch. It was clear to me that the conference organizers know exactly how people derive value from the conference—and it often doesn't have to do with the speaker lineup.

Skills & mobility tech vendors were missing from the exhibition hall

Finally, it was interesting to note that a number of key skills and internal mobility vendors didn't have booths in the expo hall. Instead, I saw lots of LMSs, LXPs, microlearning platforms, coaching offerings, and content providers.

I should note that some of the vendors who did have booths are doing some really interesting things with skills. They're incorporating skills data into their products and using skills to, for example, make tailored content and learning recommendations. But in these cases, skills tended to be part of the offering rather than the offering.

The mix of vendors who were in the expo hall isn't surprising; it's pretty standard for most learning tech conferences. Still, given how important skills tech and talent marketplaces are within learning tech right now—and given the interest in skills expressed by conference attendees—I was surprised not to see at least a few of the bigger players.

Wrapping Up

The next Learning Technologies event is their Autumn Forum, a 1-day follow-up to the May conference that'll be held in October 2022. The Autumn Forum is included in the price of the May conference ticket, and attendees told me they like the opportunity to reconvene after less than a year. It helps keep ideas fresh.

Next year's conference has already been scheduled for 3-4 May, 2023. I have to say that, weather-wise, London in May is much more pleasant than London in February. Shifting the timing of the conference is perhaps one of the silver linings of COVID. I look forward to next year.

Visier Gets in the Collaboration Analytics Market with Yva.ai Purchase

Posted on Tuesday, May 10th, 2022 at 5:29 PM

Last week, Visier announced its acquisition of the assets of Yva.ai (pronounced ee-vah, like the alien robot in Wall-E), an AI-driven collaboration analytics vendor. This is interesting news in our space because of what it says about:

- The shifting use cases in the PAT market

- The rising importance of continuous, passive data analytics

- The continued consolidation of people analytics tech

This blog took a little while longer to write than usual because there’s a lot to say about these two different technologies and the shifts within the market. In the below, we cover the following:

- Overview of Visier and Yva.ai

- Background on Multi-source Analysis Platforms (MSAPs) and shifting people analytics tech use cases

- What is a collaboration analytics tool?

- What is Yva.ai?

- Why did Visier acquire the assets of Yva.ai?

If you aren’t looking for any background on the space, feel free to skip bullets 2 and 3.

Overview of Visier and Yva.ai

Let’s begin with a quick review of who is who (see Figure 1). Visier is what we call a “multi-source analysis platform” (MSAP), meaning it connects data from existing HR systems (e.g., HRIS, LMS / LXP, TM) and other operational systems (e.g., sales or customer data) and enables robust analysis and distribution. Yva.ai is a collaboration analytics tool that combines data from corporate tools, such as Microsoft Office 365 and Microsoft Teams, Zoom, Slack, and other collaboration tools, and enhances it with weekly sourced peer-to-peer feedback.

Background on Multi-source Analysis Platforms (MSAPs)

Before we get to more specifics on Visier and Yva.ai, let’s first talk about what MSAPs are and their current opportunities and limitations. As mentioned above, MSAPs allow companies to integrate data from existing HR and other operational systems, analyze that data, and distribute insights about it at appropriate levels of security throughout the organization. These insights are used by people analytics and HR leaders, and, increasingly by business leaders, managers, and individual employees.

There is an incredible amount of power in this type of system. By bringing together disparate data, these systems can create a single, integrated source of data truth, which can then be used to answer critical questions about what is happening with the workforce. Our research shows that effectively using integrated people analytics data can help impact businesses in terms of millions and sometimes billions of dollars, as we wrote about in our report, Unlocking the Hidden C-suite Superpower: People Analytics. These types of significant business outcomes are typically the result of people analytics teams working to help answer strategic business questions, with the support of the CHRO and senior business leaders, who make the final decision.

Yet, the people analytics team is only so big in any organization and can only answer so many questions themselves. By putting data into the hands of more business leaders, managers, and employees, organizations could enable more people to make better, data-backed decisions about people, and thus better enable those organizations (and people!) to thrive. This is the dream that many of us in people analytics have for the future.

Shifting PAT Use Cases

Putting data in the hands of the masses is not just a dream for vendors – in fact, it is a necessity for their future. As shown in Figure 2 (a sneak peek into next week’s release of the People Analytics Tech study), we’ve found that the use cases for people analytics tech are changing. Specifically, as people analytics teams increase in sophistication, they use vendors – especially MSAPs – to integrate increasingly complex data. At some point, though, some of the people analytics teams will take this holistic, integrated data set out of the multi-source analysis platform and put it into a centralized data lake, doing less of their work in the platform. This allows those PA teams to do more sophisticated research and analysis.

Yet, that doesn’t mean MSAPs are no longer important – in fact, it is just the opposite. This is when these systems can become the most valuable. As the data become richer and more continuous (meaning they change and update on a continuous basis), they have increased value in terms of helping business leaders, managers, and employees make better decisions. MSAPs are superb at scaling and sharing data and insights across complex enterprises. Further, given the time that it takes organizations to adopt new technologies, it is just at this point (between Phase 2 and Phase 3 in Figure 2) that these technologies start to be adopted at the scale necessary to drive meaningful insights across the business.

However, for MSAPs, there is a stumbling block in achieving this dream of ubiquitous use: The data these systems integrate often doesn’t change frequently enough to entice senior business leaders, managers, or individual employees to want to look at it continuously (e.g., daily). (Sorry friends, I know some of you will disagree. However, our research shows that 17% and 8% of MSAPs are accessed daily by people managers and employees, respectively. And, to be honest, I think there might be some inflation in those numbers.)

This is not the fault of these solutions. It is, instead, due to the nature of the data they pull in; for example, promotions only happen a few times per year, engagement data are still only collected annually or semi-annually in many organizations, and learning data may not be as robust or relevant as everyone hopes. This is a problem that MSAPs must solve if they are going to get to the next level of adoption across their non-HR / people analytics end users.

And so, with that understanding of what is happening for MSAPs, let’s turn to the other partner in this acquisition: Yva.ai, a collaboration analytics tool.

What is a collaboration analytics tool?

A collaboration analytics tool allows leaders to bring together passive data that are generated through employees’ daily interactions with each other – think Microsoft Office 365 and Microsoft Teams, Zoom, Slack, and other collaboration tools – and generate insights from those data.

There are some real benefits to these types of tools. For example,

- Analysis of these data can be highly predictive of burnout, turnover, etc., so this can help leaders identify and address challenges earlier

- These data do not have to be collected actively (e.g., via a survey), so employees don’t have to be disturbed / leaders don’t have to wait to ask employees how they are doing

- These data can be delivered back to employees to give them heightened self-awareness

Yet, as you can imagine, there are also some concerns with these types of tools:

- There may be concerns of “Big Brother” monitoring, which can erode trust, if it is not made clear what data are being collected and analyzed. Many tools require employees to opt in – not opt out – which can help address this concern. Also, companies can control the level at which data are reported, so information isn’t necessarily tied to individual employees.(Note: We wrote separately about some of these issues in this blog about Cultivate when it was acquired by Perceptyx.)

- Managers may not use these insights appropriately if they don’t understand that they are predictions, not certainties. Further, some managers may use this information to target specific individuals if they already suspect that they are planning to leave. This can be addressed by controlling the level at which managers can receive these data / insights (e.g., not reporting on fewer than 5 employees) or rolling these capabilities out slowly so as to train / enable managers appropriately.

Despite these concerns, it is important to recognize that using collaboration analytics will increasingly become the norm, especially in locales not restricted by GDPR. There is simply so much power in these data that it is unlikely they will remain ignored for much longer.

What is Yva.ai?

Yva.ai is a collaboration analytics tool and was a spinoff from ABBYY, an AI company that helps customers with their digital transformations. Until last week, Yva.ai focused on helping customers understand employee dissatisfaction by combining active and passive employee data and using it to understand employee well-being. It also uses AI models to help companies predict resignations and address the issues that might be driving them.

Some of the differentiators for Yva.ai include:

- Helps companies avoid employee resignation by detecting and addressing burnout early

- Predicts employee resignations within a week with 94.5% accuracy, within 5 weeks with 88% accuracy, and within 3-6 months with 70% accuracy

- Combines active data collected from weekly micro surveys with passive collaboration data

- Enhanced data security for passive data analysis that only looks for semantic signals and destroys the contents after analyses

- Offers smart feedback capabilities: The system can identify employees who should be asked about whom and when, based on passive data collection

When we conducted our review of Yva.ai a few months ago, some of the things that most excited us about the tool included:

- Personal dashboards for employees based on data collected on and from them that allows them to compare their data against organizational level data and share insights with others

- The increased focus on data anonymization, employee privacy, and security by aggregating data, allowing employees to opt-in and opt-out of data collection when they want, and ensuring customers either self-host their data on the cloud or on-premise

- Additional frequent listening capabilities through pulses and micro surveys for companies that only have annual or quarterly engagement surveys

Finally, a few other things of note about the company:

- Organizational network analysis capabilities allow understanding of who works with whom across office collaboration tools such as Slack, Teams, Jira, etc.

- Natural Language Processing (NLP) capabilities to analyze anonymized text data collected from office collaboration tools such as Slack, Teams, Jira, etc.

- Diversity metrics are built-in as a core module, available throughout the entire platform

- Smallest unit at which it reports data is a group of 5 individuals

Why did Visier acquire the assets of Yva.ai?

The primary reasons Visier bought the assets of Yva.ai include:

- The ability to connect what people are doing to outcomes

- The creation of sticky, continuous insights for non-HR / people analytics users

- The underlying AI and NLP technology

Connecting how work is done to outcomes

The headline reason for this acquisition is that it will allow Visier to connect insights on how people are working to the outcomes they produce. This should allow companies to better understand their employees and make better decisions. As Visier CEO Ryan Wong stated:

“Collaboration analytics reveals new insights into how people and teams work together. It enables us to go from understanding “who” and “what” to answering questions about “how” people work best… Now, our customers will have a 360-degree view of what their employees do, how they feel and how they work together. The Visier People Cloud’s outcome-focused insights give leaders the guidance they need to make better decisions. Ultimately, it’s our belief that the companies that best understand their employees will be the ones that thrive in the future of work.”

Creation of sticky, continuous insights for non-HR / people analytics users

As mentioned above, many MSAPs are looking to engage non-HR / people analytics leaders more. The acquisition of a tool like Yva.ai helps Visier address this challenge. Collaboration data can tell users something meaningful about their workforce (or themselves) on a daily (or weekly basis). Again, CEO Ryan Wong identified this as a primary objective for the acquisition

“Leaders can use this combination of active and passive listening capabilities to gain deeper insight beyond individual workers and focus on relationships within networks of people, and the overall wellness of their teams. With this knowledge, managers gain a better understanding of team dynamics and employee well-being. But beyond the leadership benefits, these insights also empower every worker. Employees can gain a deeper understanding of where they are spending their time and who they are working with, and uncover pathways to improving their interactions, collaboration and performance.”

The underlying AI and NLP technology

Yva.ai has some of the most sophisticated AI and NLP technology available on the market right now. With the vast amounts of data available at its disposal, Visier will certainly find interesting ways to deploy that technology. Our hope is that they will use it to simplify the process of finding insights for business leaders, people managers, and employees.

Additional thoughts

One of the interesting things about this deal is that it is an acquisition of the assets of Yva.ai, not of the company as an entire entity. This is typically a strategy acquiring companies use to reduce risk and potential losses, as it enables them to cherry-pick which parts of the company they want, often leaving undesirable portions (like liabilities). We don’t know why Visier chose this approach as opposed to a traditional acquisition strategy.

One of the implications of an asset acquisition, though, is that Visier did not automatically bring over all the employees from Yva.ai. They did, however, hire more than 30 Yva.ai engineers and data scientists, the majority of its global workforce. This additional headcount should strengthen Visier’s tech capabilities, in a time when it is really hard to hire engineers.

Some of the questions we still have about this acquisition are:

- Cultures: This is Visier’s first acquisition, so it is just building its muscle at integrating outside technology and teams into its organization. This deal will bring in a portion of the Yva.ai team, many of whom have been working at the cutting edge of AI and machine learning technology, and in different locales than Vancouver-based Visier. There may be a very different set of cultural expectations between these teams.

- Leadership: It’s not clear what role Yva.ai’s CEO, David Yang, will have within Visier. However, he has clearly been the visionary behind Yva.ai’s tech, and we wonder what will happen to that vision and Yva’s execution capabilities if he leaves or does not remain in a position of product leadership.

- Data privacy and ethics: Traditionally, Yva.ai has used an opt-in model for its data. We wonder how that will work as Visier tries to tie those data to the rest of its data – and what happens to them if / when employees opt out. And how that then impacts the value proposition for business leaders and people managers?

Moving forward

The collaboration analysis tool market will continue to grow as more companies realize the power of data they are already sitting on and become more accustomed to using it. That said, we expect to see many of the vendors in this space entering into partnership agreements or getting purchased, as these data and the associated analysis are fundamentally more powerful if they are connected to other types of data. Therefore, expect to see some action with some of the other vendors in this space such as Glickon, Network Perspective, RSquared, Swoop Analytics, and Worklytics.

Update on Workday Innovation Summit 2022: Growing Beyond the “Power of One”

Posted on Tuesday, April 26th, 2022 at 12:34 PM

Workday’s annual Innovation Summit was on April 14, and it was a mix of updates on the business and insights into what will come next. (Sorry for the late update — #childcarewoes) It was wonderful to be back in person for an analyst day (so many hugs!) and to share the types of things that only get said over a glass of wine or dinner.

Starting at the 30,000-foot level… here are my key takeaways from the day:

- Rapid revenue growth: Workday is planning to grow its revenue from $5 billion to $10 billion in the next 4 years and plans to do so by increasing customer wallet share, “winning” the office of the CFO with an industry approach, growing internationally and within medium-sized organizations.

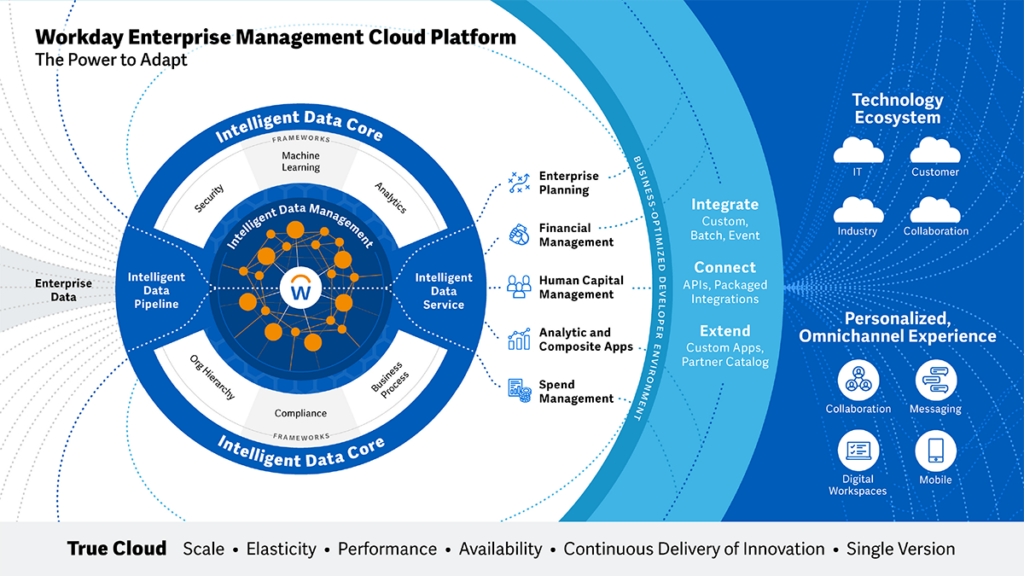

- Greater openness: To achieve these objectives, Workday is evolving its historical tagline of “The Power of One” to “The Power to Adapt,” – which means a more open cloud ecosystem and more acquisitions and partnerships.

- More EX: Workday is doubling down on employee experience, meaning better UX design, a more holistic approach to employee experience, and a greater focus on employee-centric topics (skills, engagement, and DEIB).

Rapid revenue growth

Like many other HR tech vendors in 2021, Workday experienced strong growth last year – 22% for its FY22 (which ended January 2022). Co-CEO and Chairman, Aneel Bhusri said this is the strongest growth Workday has experienced in the last 4-5 years. The customer numbers they shared for the last year (as of January 2022) are:

- All Workday customers: 9,500+

- Workday Adaptive Planning: 5,900+

- Workday Recruiting: 3,100+

- Workday Human Capital Management: 4,050+

- Workday Time Tracking: 2,775+

- Workday Payroll: 2,625+

- Workday Learning: 1,975+

- Workday Financial Management: 1,300+

- Workday Procurement: 1,100+

- Workday Prism Analytics: 925+

- Workday People Analytics: 500+

- Workday Strategic Sourcing: 400+

Executives put forth a much bigger goal for the future: 20% growth YOY until they hit $10 billion in revenue, which they forecast to happen in 4 years. This means that while it took Workday 16 years to get to its first $5 billion in revenue, executives now expect to double its income in a quarter of that time.

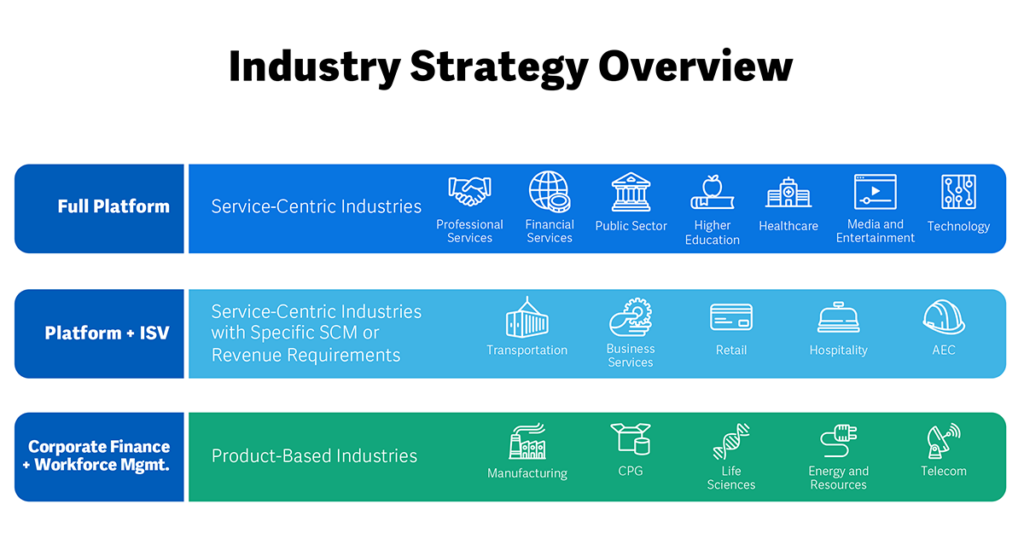

To do this, Workday executives want to be the leader in HCM across industries and a leader in financial-services-based industries. Specifically, they are looking to do the following:

- Increase customer wallet share. This means extending Workday's offerings into other organizational silos (e.g., from Finance to HR) and strengthening their standing with CIOs. This strategy seems to be working so far, given that 40% of new ACV comes from Workday's existing customer base, up 20% from a few years ago.

- Win the Office of the CFO with an industry approach. Workday recognizes that it needs a deeper industry approach, particularly for finance. They had 1,300 FINS customers in FY22, up 22% YOY, reflecting about 1,500 deployments across core finance products in FY22. (See the image below.)

- Grow internationally. Workday is looking to extend its international footprint, particularly in the UK, Germany, France, and Australia.

- Move into the medium enterprise (500-3,500 employees). To expand further into medium-sized enterprises, Workday is simplifying and streamlining the go-live process. Specifically, it developed Workday Launch (1,400 customers last year), making Workday 35-40% less expensive to deploy and shortened deployment timelines by 35-50%. Last year, new ACV growth from medium enterprises was more than 40% YOY.

My take:

This revenue goal is the definition of a BHAG (big, hairy, audacious goal), and I applaud Workday executives for putting it out there. Their four-prong strategy for achieving this BHAG – especially the components focused on expanding within existing customers and offering industry-specific capabilities – seems solid.

That said, Workday is already in half of the Fortune 500, and while I know there is still another 50% to go after, I imagine SAP and Oracle will defend that turf vigorously. As Workday extends into international and mid-sized markets, they may find it harder than they anticipate to achieve the revenue numbers they hope for, given those customers' comparatively lesser buying power.

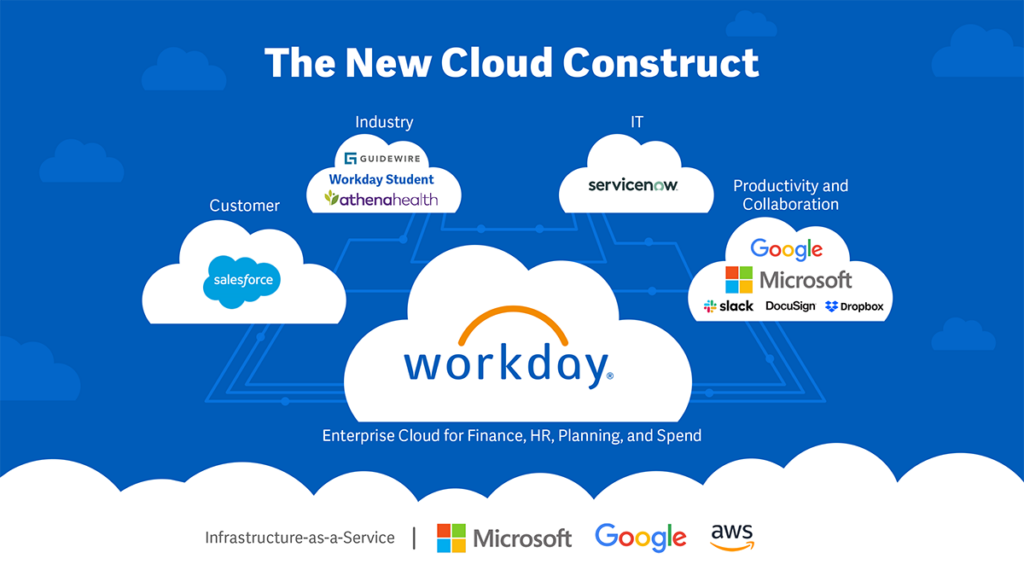

“The Power of One”: Now “The Power to Adapt”

Workday's tagline, “The Power of One” (referring to their integrated, single platform and data model), has been a mantra at the company for forever.

Therefore, my ears perked up when Patricia Harris, SVP of Solution Marketing, said, “’The Power of One’ is now about ‘The Power to Adapt.’ We are not on an island. CIOs need to take advantage of these multi-cloud architectures.” Pete Schlampp, Chief Strategy Officer, went even further, talking about how Workday is the “mesher of the enterprise,” weaving together information needed by CIOs, CFOs, and CHROs. The idea is that Workday should be the tool used by all these different functions to make critical business decisions.

To do this, Workday needs to help organizations have more capacity to use its systems strategically. Therefore, Schlampp talked about how they are focused on eliminating the extra manual processes leftover from legacy systems. And when those processes cannot be removed, Workday needs to become a “drudgery automator,” enabling people to focus on more strategic tasks. (BTW, “drudgery automator” may be my favorite term from the day… but “mesher of the enterprise,” with its similarity to “master of the enterprise,” is a close second.) The September 2021 acquisition of Zimit, a configure price quote (CPQ) solution built specifically for services industries, is an example of a “drudgery automator” and a single-industry focus.

This brings us to the next point – which is how Workday plans to both enable customers to adapt while at the same time adapting themselves to those customers' needs. Executives pointed to a robust build / buy / partner approach, with Schlampp reiterating, “Workday's primary method of innovation is through organic development, and it will always be that way.”

That said, Workday has been heavily acquisitive in the last five years, with acquisitions of companies such as Platfora (2016), Adaptive Insights (2018), Scout (2019), and Peakon, Vndly, and Zimit all in 2021.

From an outsider's perspective, these acquisitions have created tension with the “Power of One” messaging – so perhaps this switch to “The Power to Adapt” is overdue. Regardless, the company remains focused on maintaining as much of its single platform / data model approach as possible. According to Bhusri, Workday “…will go to much greater lengths than anybody to integrate products. That is the focus of the first year of integration and product development after acquisition: Unify data models, security systems, and, workflows (so they flow seamlessly). Inside Workday will always be ‘The Power of One.’”

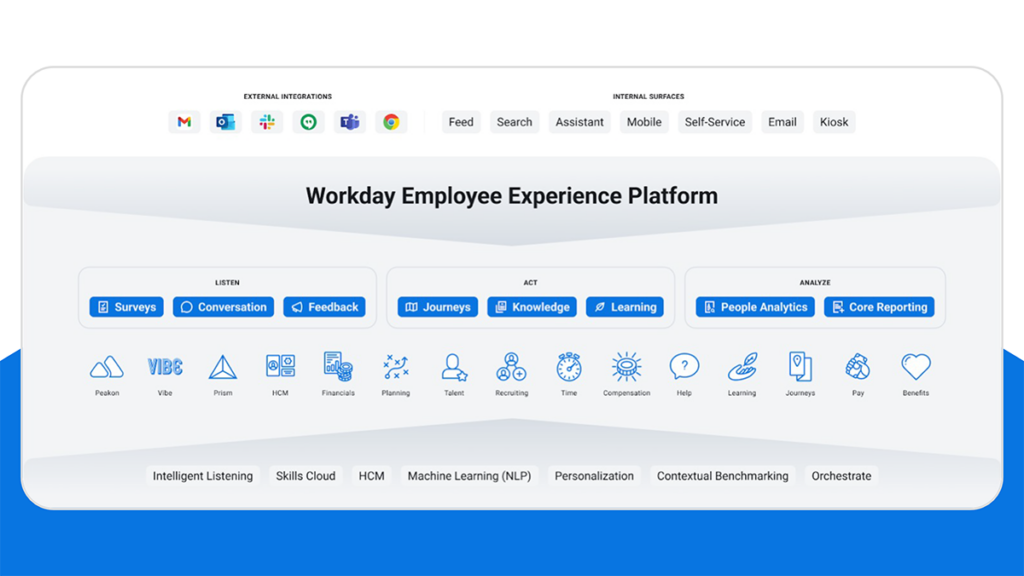

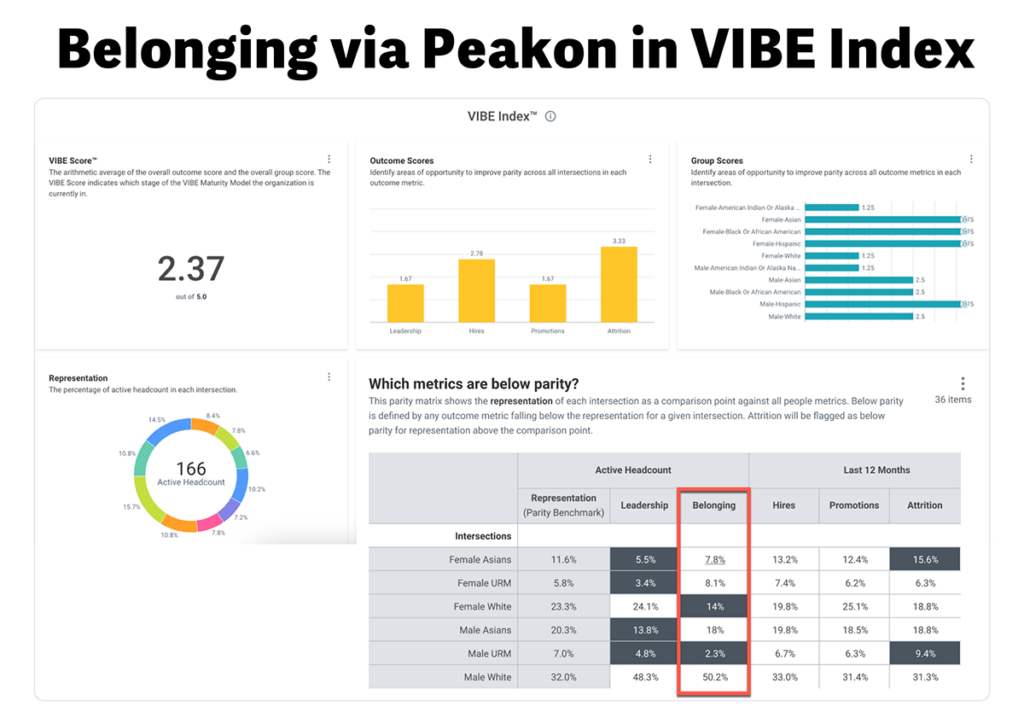

Workday's vision is to create a unified digital experience, appropriate content in the context of other applications / systems (e.g., VIBE data within Peakon), and what it calls “intelligent interaction routing.” To do this, Workday is focused on three elements:

- Integrate: Custom, Batch Event

- Connect: APIs, Packaged Integrations

- Extend: Custom Apps, Partner Catalog

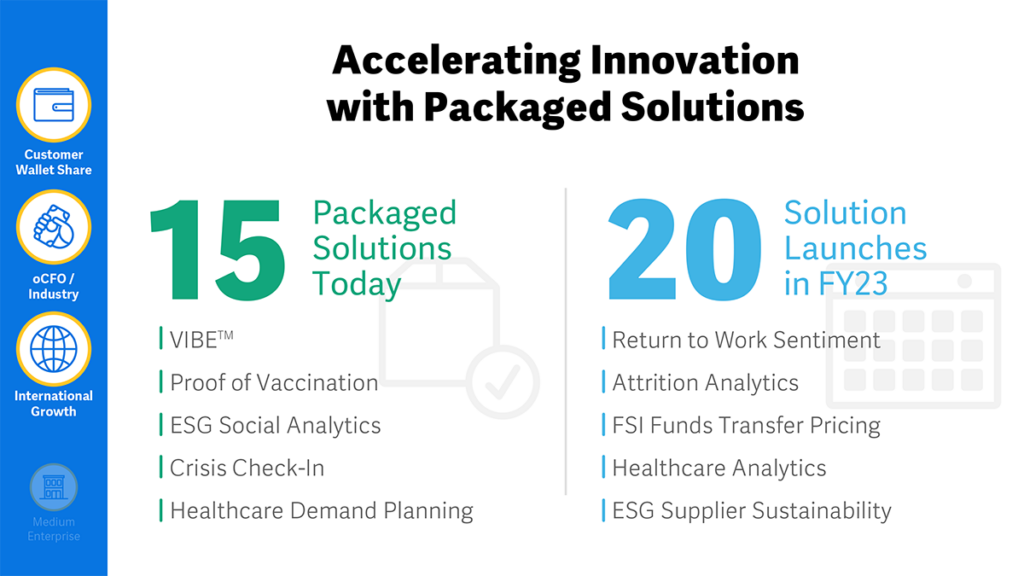

The final element of the focus on adaptation is partnerships, and Workday has increased its focus here to be able to respond to customers’ needs more quickly. Specifically, last year, Workday stood up a separate team to support what is called “Workday Packaged Solutions,” which are solutions custom-built by Workday or partners to quickly respond to changing market dynamics and develop unique industry and line of business solutions, and simplify cross-product orchestration. Notably, the Packaged Solutions team is separate from the core engineering team to not distract that team from continuing its work.

Examples of these solutions include Workday's proof of vaccination solution, ESG analytics, and the VIBE Index, all of which were responses to fast-developing business issues. Today Workday has 15 of these solutions and intends to launch 20 new solutions this year (see Image 3).

My take:

As mentioned above, a pivot away from “The Power of One” to “The Power to Adapt” was likely overdue. The tech world is about ecosystems, and it was good to hear Workday acknowledge that clearly. There is incredible value in effective data integration and a single source of data truth. Therefore, Workday's integrate, connect, and extend framework – and all the work that will be necessary to make that a reality – is essential for this next phase. If Workday truly wants to be the “mesher of the enterprise,” it must get this right.

Given Workday's big financial goals, I expect its leaders will double down on acquisitions that support its focus on automating drudgery, deepening industry expertise, and serving international and medium-sized enterprises. (The exception to this is payroll provider acquisitions: Workday is building its own for global markets and won't be looking to acquire those). It will be also likely partner much more than we've seen to date, especially as the volatility of the world requires it to be ever-more sensitive to customers' needs. I'd be willing to bet that there will be a lot of other variations of “Packaged Solutions” next year – not just different solutions.

Beyond HCM: Simplify the Digital Experience, Elevate the Human Experience

Finally, Workday executives talked a lot about employee experience and see their entire platform as coming together to help the organization “Listen, Act, and Analyze” (see image).

To do this, Jeff Gelfuso, Workday's Chief Design Officer, talked about how they need to “make work effortless” by focusing on:

- Workday Engage: Improve the quality and cohesion of the user experience by making it simple and easy to use. (Heavy focus on UX mentioned throughout the day)

- Workday Everywhere: Meet users where they are by bringing their experience to their natural workspaces. (Hello, new mobile-first versions of Workday!)

- Workday Empower: Personalize and automate work through predictive AI/ML so they can focus on the work that matters most. (Drudgery automator)

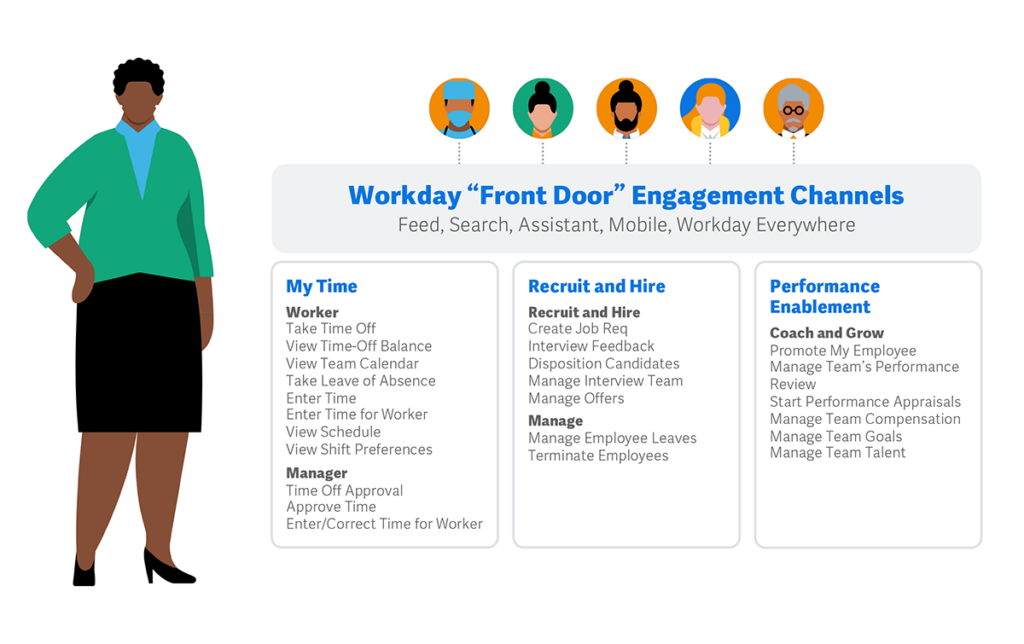

Following this, Ali Fuller, GM of Employee Experience, talked about the need to simplify the digital experience to elevate the human experience (My response on Twitter: YAS Sister!!). An example of this is the single “Front door” Workday is planning to create for managers which will put all the information they need on a weekly basis in one place (see image).

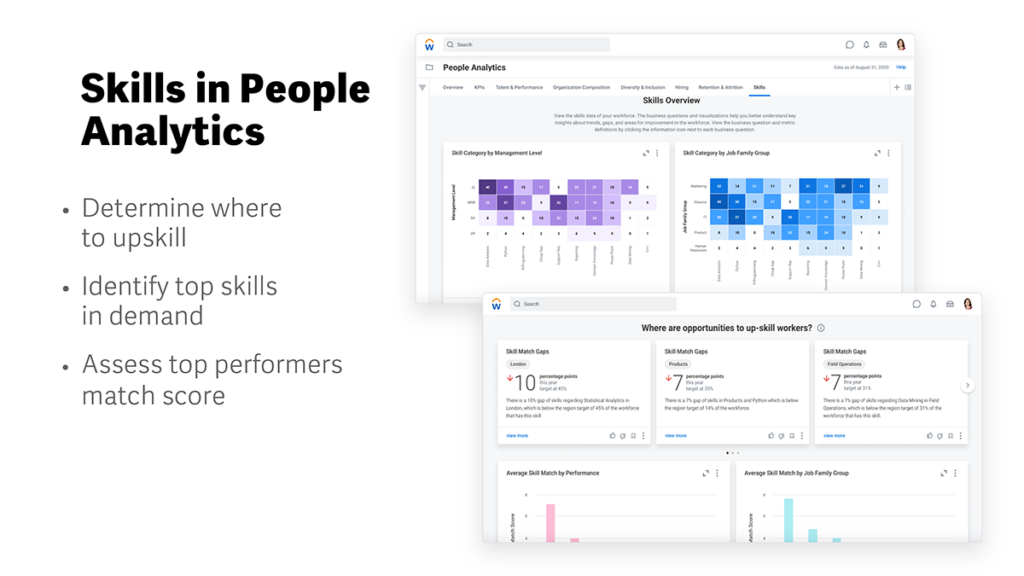

In addition, Workday leaders discussed their employee-centric offerings, such as skills, engagement (Peakon), and VIBE (Valuing Inclusion, Belonging, and Equity) solutions. I've covered these topics in other articles about Workday so that I won’t spend much time on them here.

David Somers, Group GM, Product – Office of the CHRO, shared an incredibly compelling story about how AstraZeneca (AZ) used Workday's Skills Cloud to help develop its COVID-19 vaccine. According to Sommers, AZ was not a significant player in vaccine development but wanted to create a vaccine. They used their Skills Cloud instance to figure out who had vaccine management skills within their organization. AZ spun up a team based on that data to work with the Oxford team. The result was the development of a new vaccine in just 10 months.

My take:

Focusing beyond traditional HCM approaches is critical for Workday, and Gelfuso's framework is a good start. I especially like the focus on cleaner UX and single-stop locations for managers. Also, I think the combination of skills, engagement, and DEIB data has the power to drive remarkable changes for organizations.

However, in this area, in particular, I think Workday has many opportunities in front of it. For example, we didn't hear much about performance management, though I know from conversations with Somers that Workday is working on this area. Further, we heard very little about internal talent mobility and career pathing. Related, while talent acquisition and candidate experience were mentioned, it wasn't much of a focus – and it should be. Finally, I don't think I heard anything at all about learning.

Workday is headed in the right direction, but this third theme is the area where there is still lots of work to be done – especially if Workday will compete effectively against a lot of the more niche, agile vendors in the various talent management markets.

A few additional notable comments from Co-CEO Aneel Bhusri

There are just a few other things Co-CEO Aneel Bhusri said that I found notable and worth sharing:

- Organizational purpose: At the very start of the day, Bhusri talked about the importance of organizational purpose. Those of you who follow our work will know that purpose is super important to us, too. It sounds to me like Bhusri is being positively influenced by serving on the boards of Walmart and GM: Doug McMillan, CEO of Walmart, and Mary Barra, CEO of General Motors, were heavy supporters of the Business Roundtable's updated statement on the purpose of an organization (to focus on all stakeholders, not just shareholders).

- ESG Metrics: Bhusri also talked about how he’s hearing a real buzz around ESG (environmental, social, and governmental) metrics – that CEOs “actually want to talk about it.” ESG is a manifestation of stakeholder theory, so this makes sense, given the focus on organizational purpose. We saw some new examples of ESG analytics within the Workday platform.

- Wellness and engagement: Finally, Bhusri mentioned he is “obsessed” with Peakon (employee engagement data), and he sees that in many other CEOs. Further, CEOs are thinking a lot more about the wellness of their talent – and they are thinking about fitness in terms of health, mental, and financial wellness.

Wrapping up

Workday has big goals, and it will be fascinating to see them expand and stretch to reach them. I hope that in their focus on expanding, they don't forget to invest in the talent management parts of their business. I will look forward to seeing how they progress through this year.

Bringing it All Together: Glint to Integrate with Microsoft Viva

Posted on Friday, February 18th, 2022 at 6:53 PM

One year and 2 weeks ago Microsoft launched their employee experience offering, Viva. We wrote about it back then and explained why it was a big deal for the HR tech market. Yesterday, Microsoft announced that it will transition Glint, an employee engagement solution, from LinkedIn (acquired Glint in 2018) to become a core part of Viva. The company is set to bring Glint completely into Viva in 2023.

Keeping up with the momentum from 2021, the HR tech market continues to provide us with a show in 2022.

Just last week we wrote about Perceptyx, another employee engagement and experience vendor, acquiring Cultivate, a digital coaching tool, and further enhancing its listening capabilities. While the news of Glint integrating into Viva is not nearly as surprising and market shifting (Glint was already integrating into one of the Viva modules as a partner and providing joint customers access to their analytics insights), it is still notable for a few reasons, not least of them being that it makes Viva a serious player in the analytics space.

Before we dive into the details of what this means for the customers, to Glint, Microsoft, and the HR tech market, let’s do a quick recap of what is Microsoft Viva.

What is Microsoft Viva?

Built on top of Microsoft 365 and Teams, Viva is an employee experience solution that offers four modules (see Figure 1), which combine existing Microsoft offerings into a single solution:

-

- Connections – Creates a “digital campus” where all policy, benefits, communities, and other centralized resources are available.

- Insights –Provides employees with insights on how they work, and gives managers and leaders information about their teams, burnout risk, after-hours work, etc

- Topics – Leverages Project Cortex to identify knowledge and experts across the organization, generating topic cards, topic pages, and knowledge centers (including people – not just information) for others to access – a “Wikipedia of people and information” for the org.

- Learning – Integrates LinkedIn Learning (formerly Lynda.com), Microsoft Learn, and other external sources (including LMSs or LXPs such as Cornerstone and Skillsoft) into a single location within Microsoft.

Figure 1: Summary of Microsoft Viva | Source: Glint, 2021.

When Microsoft launched Viva 1 year ago, Glint was integrating into the “Insights” module of their offering as a partner. It was providing analytics, based on combined data from Viva and Glint to the users by via Power BI dashboards in Viva for Microsoft customers and pulling Viva data into their own dashboards for Glint customers. In the near future, Glint will be completely integrated into the core Viva offering, meaning customers should be able to access insights in the tools where they work, i.e., Teams.

Let’s break this down and find out what it means for everyone involved.

What does it mean for the customers?

Overall, this should be good news for both Glint and Microsoft customers for a few reasons.

- Customers should be able to access employee insights more seamlessly. Currently, customers need to have both Viva insights and Glint, in order to access insights based on a combination of employee perception (Glint) and behavioral data (Viva insights) through dashboards in Viva or Glint. Once Glint is integrated into Viva, customers should allow users to receive these insights more easily and quickly.

- The annual engagement survey from Microsoft will be moved over to Glint and called “Employee Signals” to reflect a more continuous, always-on listening approach. This should allow Microsoft customers to capture employee perception and behavioral data holistically all in one place, without needing to add any additional vendors.

- The integration will provide users with a stronger set of capabilities that provide them with feedback, recommendations, and action items within the productivity tool they already work in, thus, enabling leaders to respond to needs in a timely manner.

What does it mean for Glint?

According to Microsoft, existing Glint customers will be able to continue to use the current Glint offering delivered by LinkedIn. New new customers can purchase the existing Glint service on a standalone basis through LinkedIn or bundled with Viva through Microsoft for now.